How to Get Your TIN ID in the Philippines | A Simple Guide

Hey friends! If you’re living in the Philippines, you might have heard about the Taxpayer Identification Number (TIN) ID. It’s an essential document that comes in handy for so many things from starting a new job to opening a bank account or even applying for loans.

In this guide, we’ll walk you through all the important details about TIN IDs: why you need one, the requirements for registration, and how to easily get your TIN ID card online. Whether you’re just getting started or need a refresher, we’ve got you covered!

Contents

What is TIN ID?

The TIN ID is a unique identification number issued by the Bureau of Internal Revenue (BIR) to individuals and businesses for tax purposes. It is an essential document used to track tax payments, file returns, and ensure that you are compliant with the Philippines’ tax laws. The TIN ID helps ensure that taxpayers are identified and monitored in the country’s tax system.

Why Do You Need a TIN ID?

The TIN ID serves as proof of your registration in the Philippine tax system. It is often required in several transactions, such as:

- Employment: Employers ask for your TIN number before hiring you, as it is necessary for filing tax returns and withholding taxes.

- Opening a Bank Account: Financial institutions often require a TIN ID when opening a bank account, especially for savings and checking accounts.

- Business Registration: If you plan to register a business or sole proprietorship, a TIN ID is essential for tax registration purposes.

- Government Transactions: TIN numbers are needed for various government-related processes, such as applying for loans, securing business permits, or filing tax returns.

Requirements for TIN ID:

Before you apply for your TIN ID, it’s important to gather the necessary requirements. These may vary slightly depending on whether you’re an employed individual, a self-employed person, or a student, but generally, the following documents are needed:

- Valid ID: A government-issued identification card, such as a passport, driver’s license, or voter’s ID.

- Proof of Birthdate: Your birth certificate (original or certified true copy) or a valid passport can serve as proof of your birthdate.

- Barangay Clearance (if applicable): Some applicants may be asked for a Barangay Clearance, especially for students or those applying for the first time.

- Application Form (BIR Form 1901 or 1902): The correct form based on your status (e.g., self-employed, employed, etc.) must be filled out.

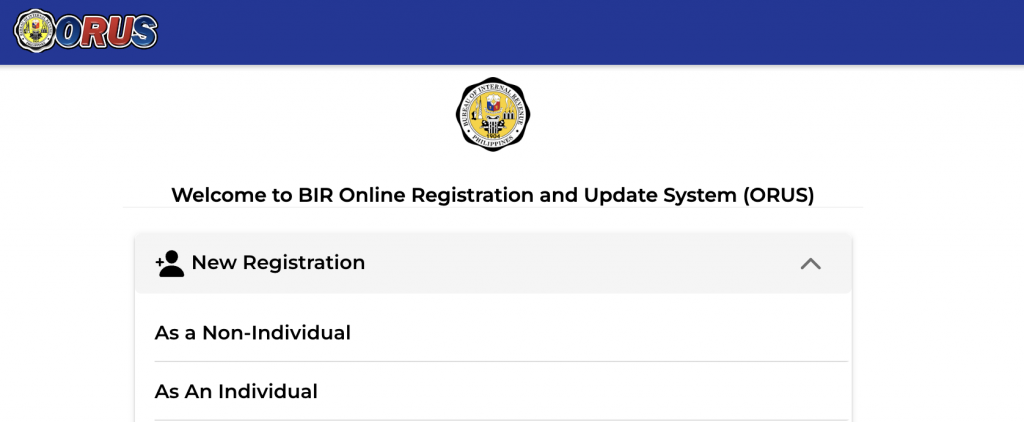

How to Get TIN ID Online Registration:

The BIR has made it more convenient to apply for a TIN ID by offering online registration. Here’s a step-by-step guide on how to apply online:

- Visit the BIR Website: Go to the official Bureau of Internal Revenue website (www.bir.gov.ph).

- Choose the Online Registration Form: You will find the online registration form, usually called the BIR eREG system or the BIR Form 1901 for self-employed individuals and Form 1902 for employed individuals.

- Fill Out the Form: Provide the required personal details, such as name, date of birth, address, and other important information.

- Submit the Form: After completing the form, submit it online and print the confirmation page.

- Schedule an Appointment (if required): Depending on the system, you may need to schedule an appointment with the BIR branch near you for document verification.

- Pay the Fees: If applicable, pay the registration fee. You can usually pay online through various platforms or at authorized payment centers.

- Wait for Processing: Once your application is submitted and approved, you will be issued a TIN.

Also Check :

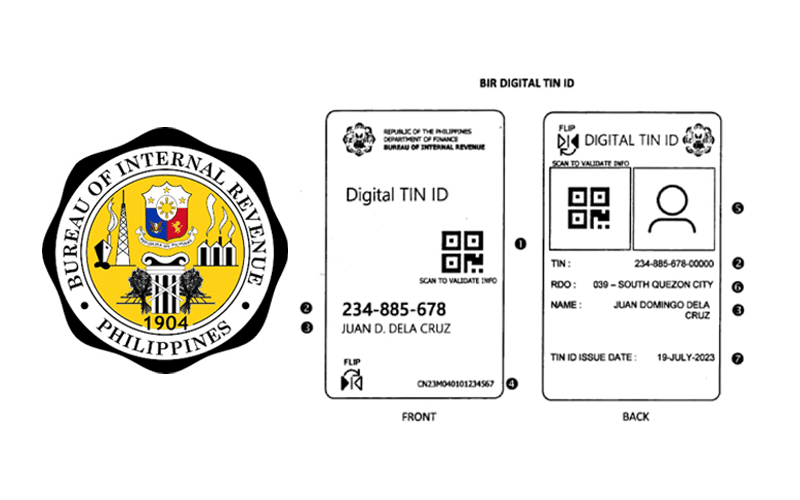

How to Get a Digital TIN ID:

For those who prefer a digital version of their TIN ID, the BIR has introduced a digital TIN ID. This can be obtained through the BIR’s online system:

- Log into your BIR account on the BIR website.

- Apply for a Digital TIN ID: Once your TIN application is processed, you can request the digital ID, which will be sent to your email.

- Download the Digital ID: You will receive a PDF version of your TIN ID, which you can print or store on your phone for easy access.

How to Get a TIN ID Card with Existing TIN Number:

If you already have a TIN but don’t have a physical ID card, you can easily get one by following these steps:

- Go to the BIR Branch: Visit your local BIR branch where you are registered. Bring a valid ID and the original copy of your TIN.

- Fill Out the TIN Card Application Form : Complete the necessary form to request a physical TIN ID card.

- Pay the Fee: You may need to pay a processing fee for the issuance of your TIN card.

- Wait for Processing: Your TIN ID will be processed and issued, typically within a few business days.

How Much is the TIN ID?

The TIN ID card itself is relatively affordable. The processing fee for a TIN ID card is typically around PHP 100 to PHP 150. The exact fee may vary depending on the location or if you are applying for additional services like a digital TIN ID.

How to Get a TIN ID for Students and Unemployed Filipinos?

If you are a student or unemployed Filipino, you can still apply for a TIN ID. Here’s how:

- Gather Requirements: You will need a valid government ID or your birth certificate, and a Barangay Clearance.

- Fill Out the Application Form: Use the BIR Form 1901 for self-employed individuals, as students and unemployed Filipinos fall under this category.

- Submit and Process: Submit the form and pay any applicable fees, either online or at a BIR branch.

Can a Foreigner Apply for a TIN Number in the Philippines?

Yes, foreigners can apply for a TIN number in the Philippines. If you are a foreigner working or doing business in the country, you will need a TIN for tax purposes. You must provide a valid passport, visa, and other required documents to complete the application process.

FAQs:

Can I apply for a TIN ID without a job?

- Yes, even if you’re unemployed, you can still apply for a TIN ID.

How long does it take to get a TIN ID?

- Processing time varies but typically takes 1-3 business days if you are applying for a physical card.

Can I change my details on the TIN ID?

- Yes, if you need to update your personal details, you can do so by filling out the appropriate BIR forms.

Conclusion:

The TIN ID is an important document in the Philippines that is needed for various legal and financial transactions. Applying for one has become much easier with the introduction of online registration. Whether you’re a student, employed, or a foreigner, getting your TIN ID is simple and affordable. Make sure to have all the necessary documents, follow the correct procedures, and you’ll be ready to enjoy the benefits of having a TIN ID in no time.